The universal API for open finance

Connect to your customers’ payment, open banking, e-commerce or accounting tools and access the most relevant data to build your product

Power your product with Qard API

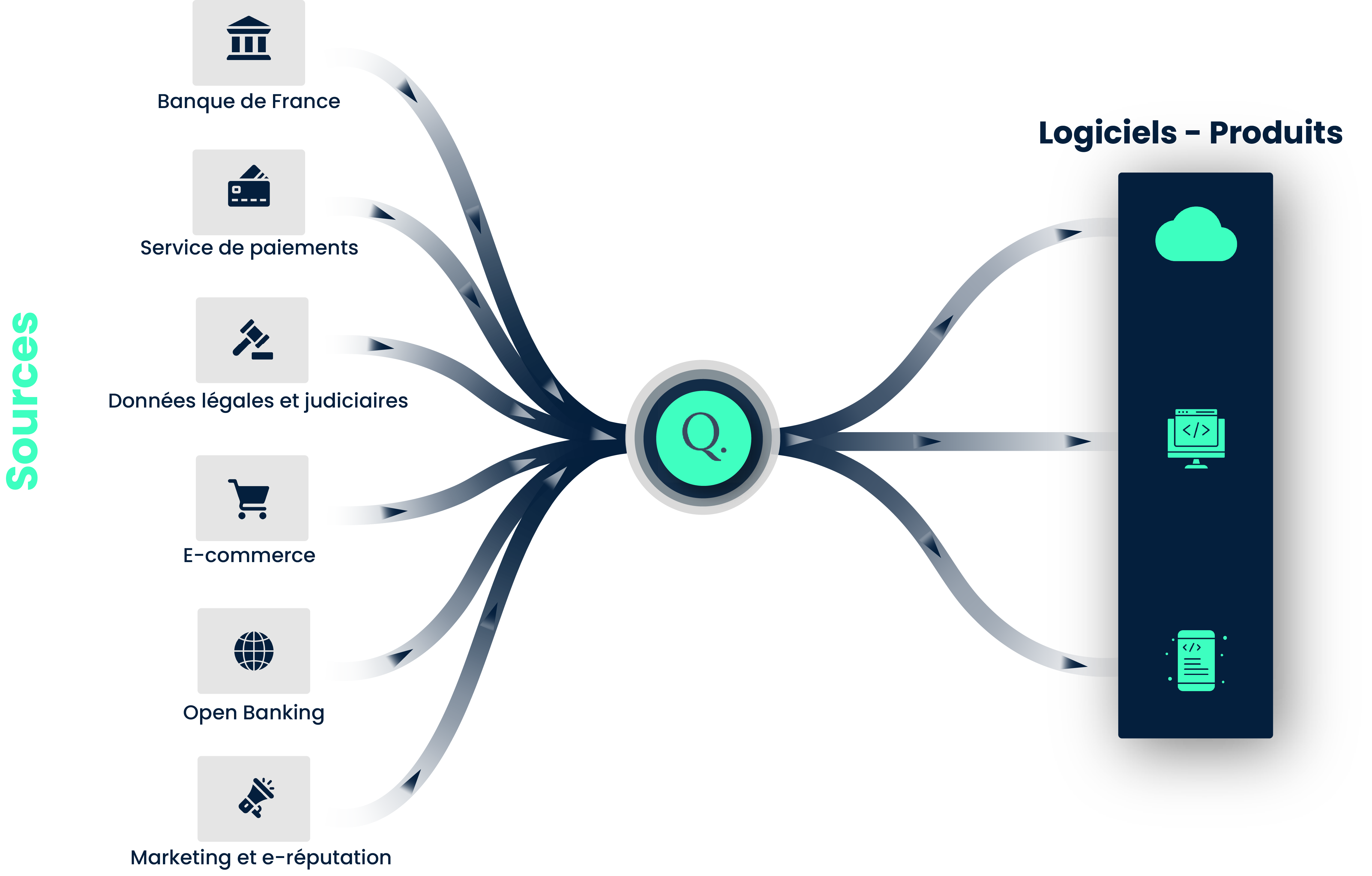

Qard enables you to better understand your customers and enrich your credit data and processes through a unique API.

A standardized and simplified API to facilitate integration

Qard collects dozens of data sources, manages them and integrates them into a unified data model for easy integration into your processes and software.

Comprehensive connection management to reduce your development and maintenance costs.

Data and insights from multiple sources for better analysis

Access to advanced data on companies and their officers by connecting directly to their platforms and tools through Qard connectors and data retrieved from official organisations

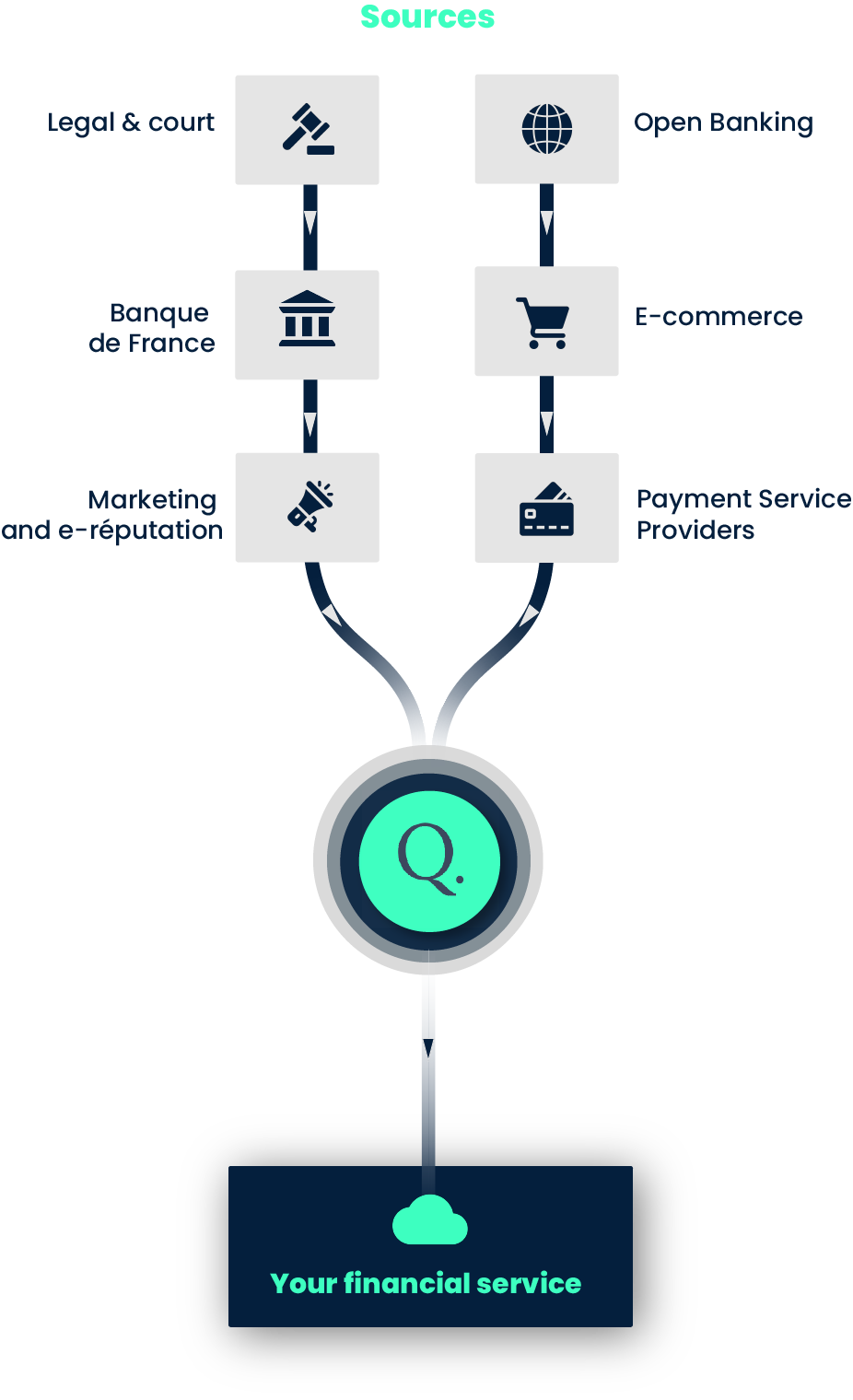

Finance

Automatically retrieve your clients’ tax returns and detailed analysis, even when they are not published

Accounting

Retrieve the Accounting Entry File and a detailed analysis

Open Banking

Access to your customers’ bank accounts to offer them adapted services, analyse their solvency and visualize defaults thanks to many insights (seizure of accounts, third-party notices, outstanding loans, etc.)

Official and legal data

Retrieve all available data from the commercial courts, including disputes, collective proceedings, management bans

Commerce

Retrieve invoices, orders, subscriptions and their analysis from your customers’ payment providers or commerce platforms

E-reputation

Get articles and reviews about your customers and prospects from press and blogs

Why build your product with Qard?

Save months of development and launch your product faster

Eliminate development and maintenance costs for integrations

Integrate our Api into an existing or brand new product with the same ease

Provide a more seamless and complete user experience for your customers

How can our API help you?

Develop your activity according to your business and needs

Risk analysis

Get instant access to legal and management data and study sales, financial and marketing performance. To help you make better decisions.

Financing and anticipating future income

Track your customers’ future revenues by looking at due dates and amounts remaining on invoices issued by your customers or subscriptions sold.

Simplify your onboarding processes

For your KYC/KYB, formalities, customer document collection or screening, access all the data you need to deliver a seamless customer journey and a successful user experience.

How does it work for your customers?

01

Platform selection

From your interface or our dashboard, your customer can select the platform you need to connect

02

Authentification

Your customer authenticates with the login links provided by Qard as a white label

03

Data retrieval

Qard collects the data for your product in real time, processes it and sends it to you

of French companies analysed

Through the same API, you can directly access all legal and financial information on French companies. The information is aggregated, enriched and then analysed using our algorithms to serve as the “data base” for all your onboarding, screening, credit risk and other processes.

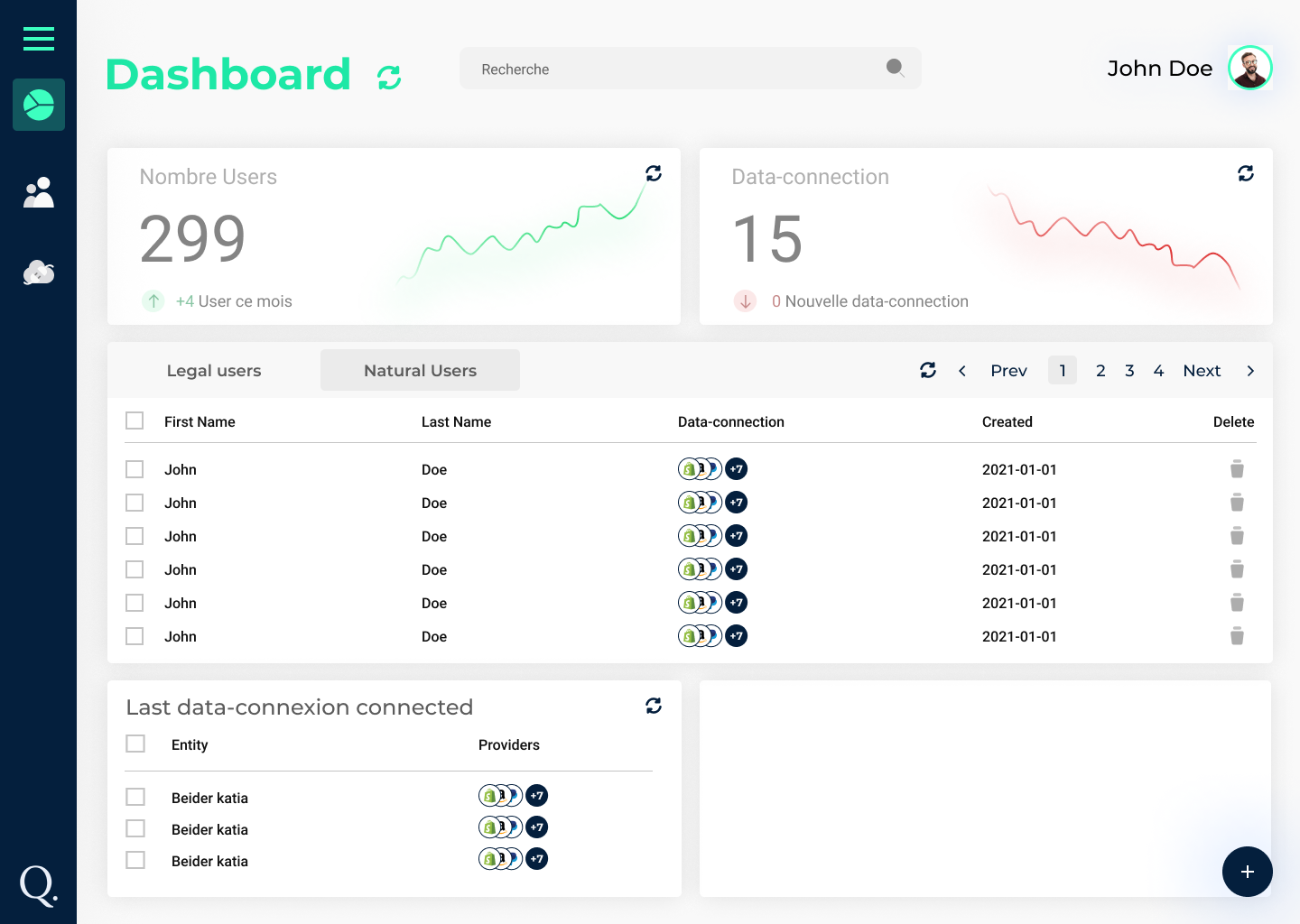

Visualize and test the power of our API on a Dashboard

Depending on your needs and analysis methods, choose to use our technology via our API or directly via our Dashboard.

You can also test and find all our analysis in a visual and intuitive way